Stablecoin Usage in Africa: Key Insights From the Mento Community Survey

At Mento Labs, we are committed to understanding how the Mento Community engages with stablecoins and their role in advancing financial inclusion across Africa. To gain deeper insights into user behavior, preferences, and challenges, we recently conducted a comprehensive community survey. The data we gathered from 612 respondents across the continent will help shape Mento Labs’ future development of the Mento Platform and ensure we are meeting the real needs of stablecoin users. Discover our survey results below.

Awareness and Usage

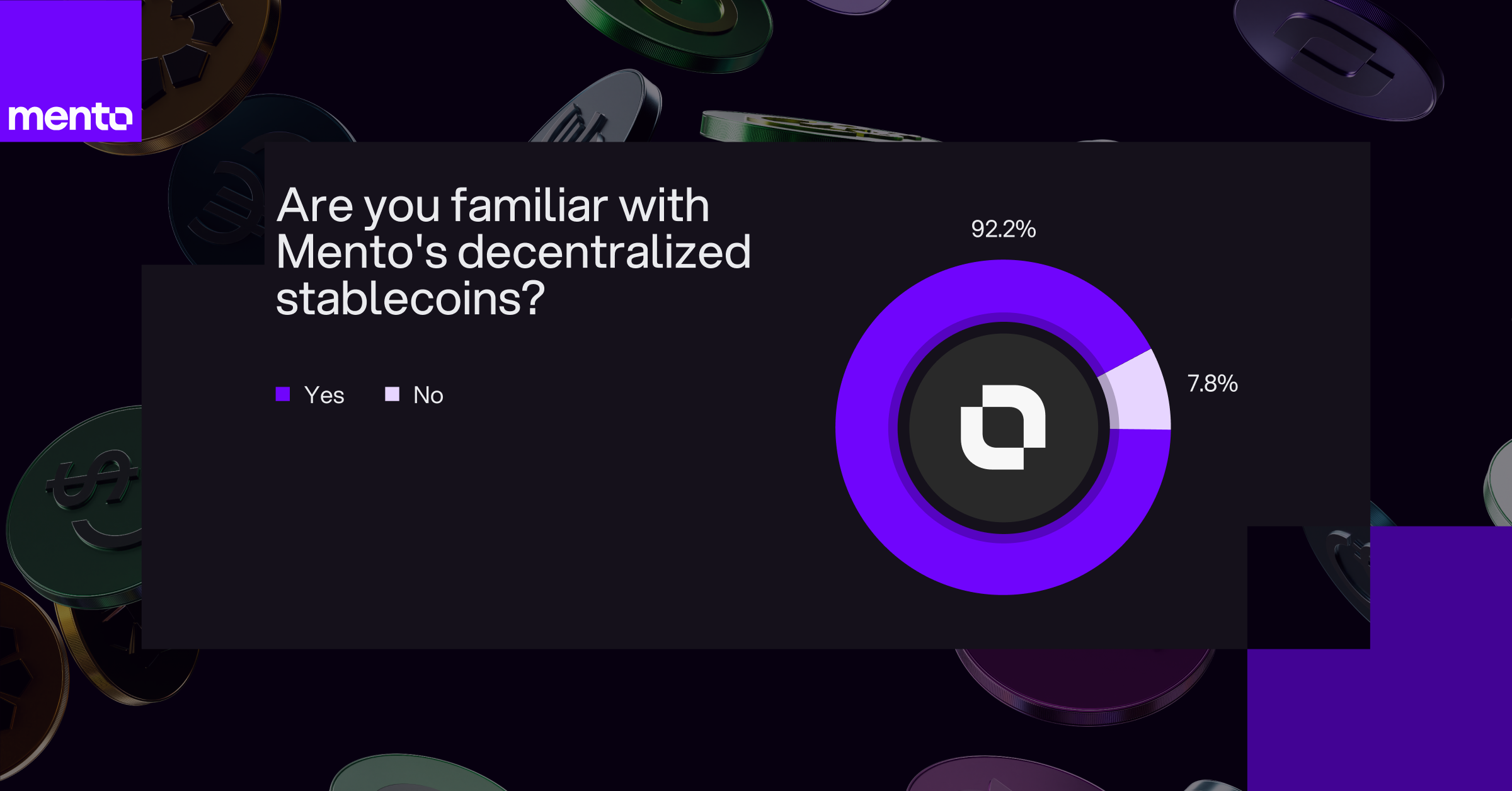

Mento decentralized stablecoins have reached broad recognition, with 92.3% of survey participants familiar with them.

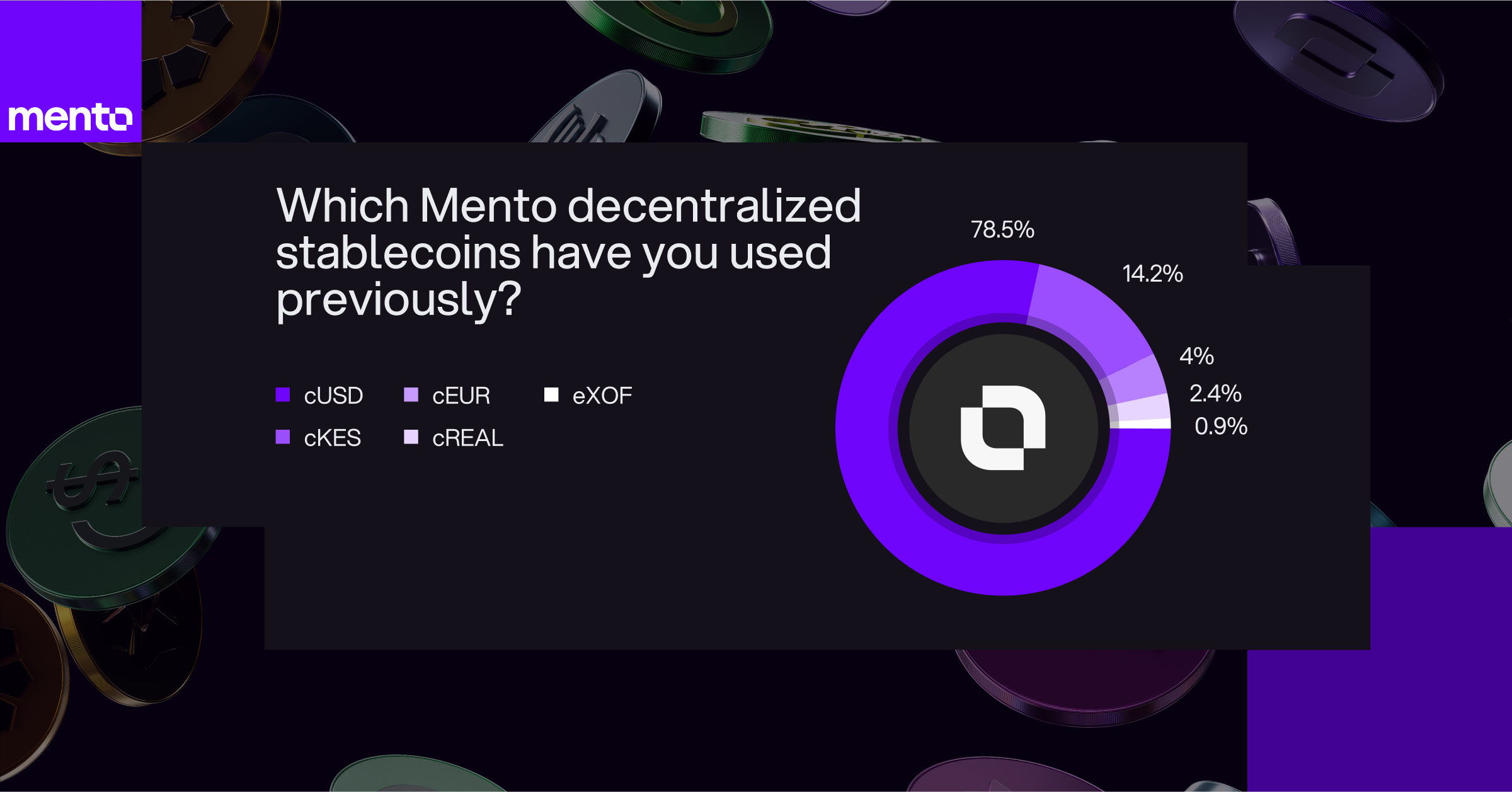

Among the available options, cUSD (US Dollar) stands as the most used stablecoin at 78.5%, followed by cKES (Kenyan Shilling) at 14.2%. cEUR (Euro) for 4% of usage, while cREAL (Brazilian Real) and eXOF (West African Franc) represent 2.4% and 0.94% respectively.

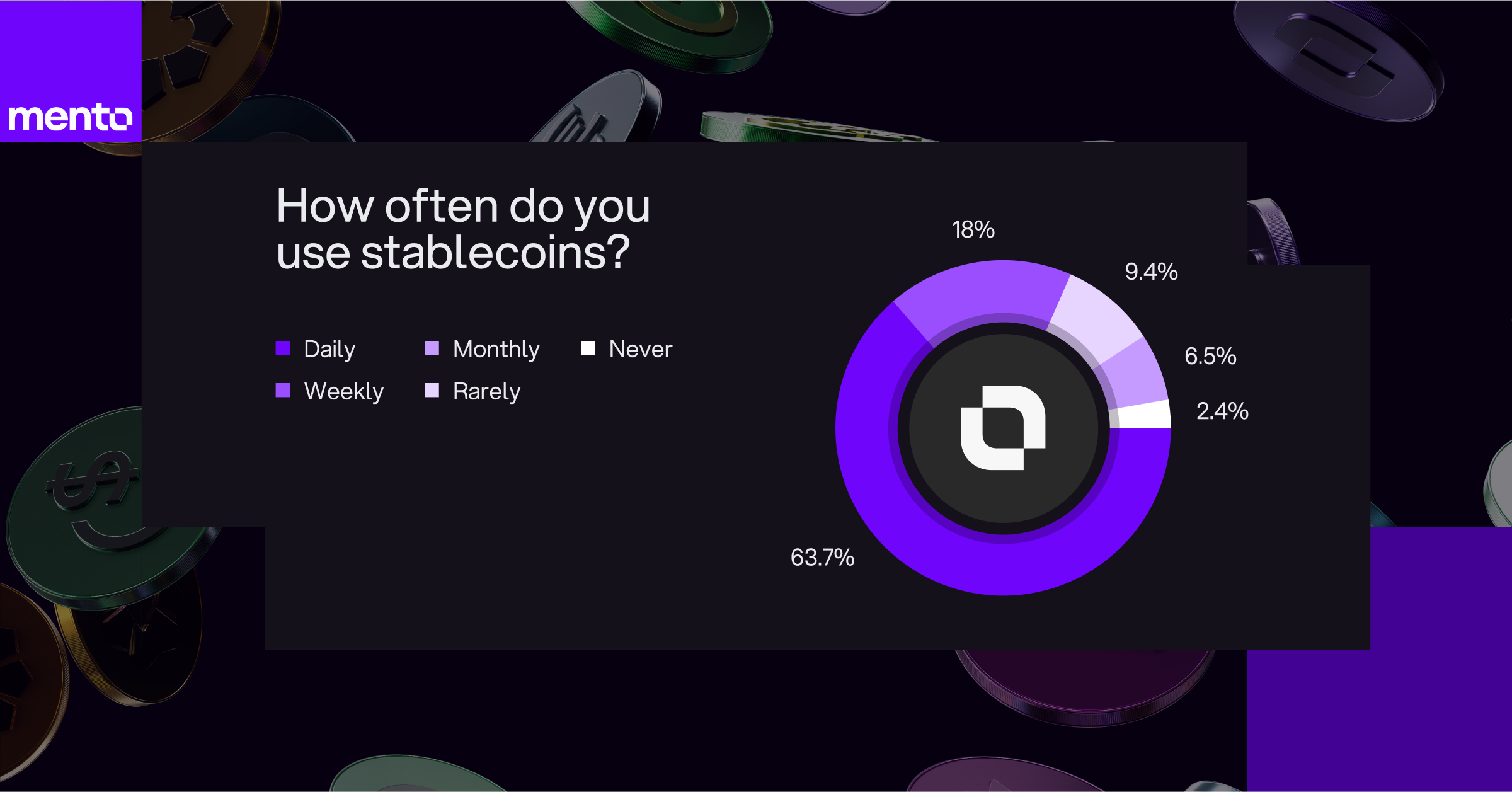

The data shows strong daily engagement, with 63.7% of users incorporating stablecoins into their daily financial activities. This high frequency suggests stablecoins have become a practical tool for everyday transactions among users in Africa.

How Do People Use Stablecoins?

Savings leads the way as the primary use case for stablecoins in Africa, making up 42.1% of activity. Participants also actively use stablecoins for payments between friends and family (18.8%), online shopping (16.7%), and crypto trading (13.3%). Salary payments and remittances, each account for 3.9% of usage, with loans at 1.22%.

User Trust and Adoption

Users in Africa have expressed strong confidence in using stablecoins, with 66.7% reporting complete comfort with these digital assets. Another 15.2% feel highly comfortable, showing broad acceptance across the user base.

Savings in Stablecoins

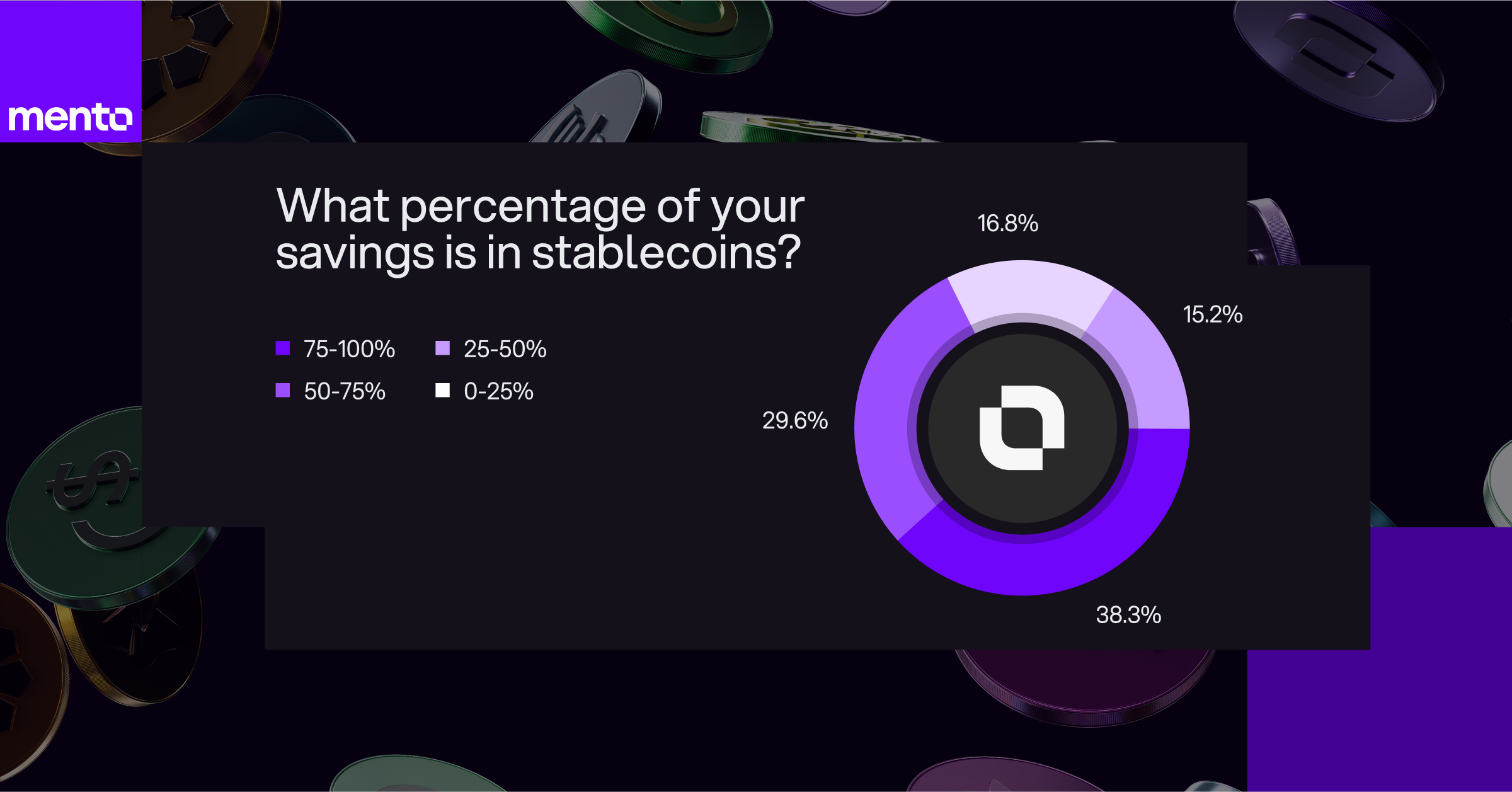

When asked about saving in stablecoins, according to our survey respondents, users across Africa are keeping 75-100% of their savings in stablecoins.

Nearly 30% maintain between half and three-quarters of their savings in these stablecoin assets.

Moving Between Traditional and Digital Money

Users in Africa access stablecoins through several channels. Bank transfers lead at 30.1%, closely followed by M-Pesa and mobile money services at 27.9%. Peer-to-peer exchanges make up 26.8% of conversions, while dedicated on/off-ramps process 15.2%.

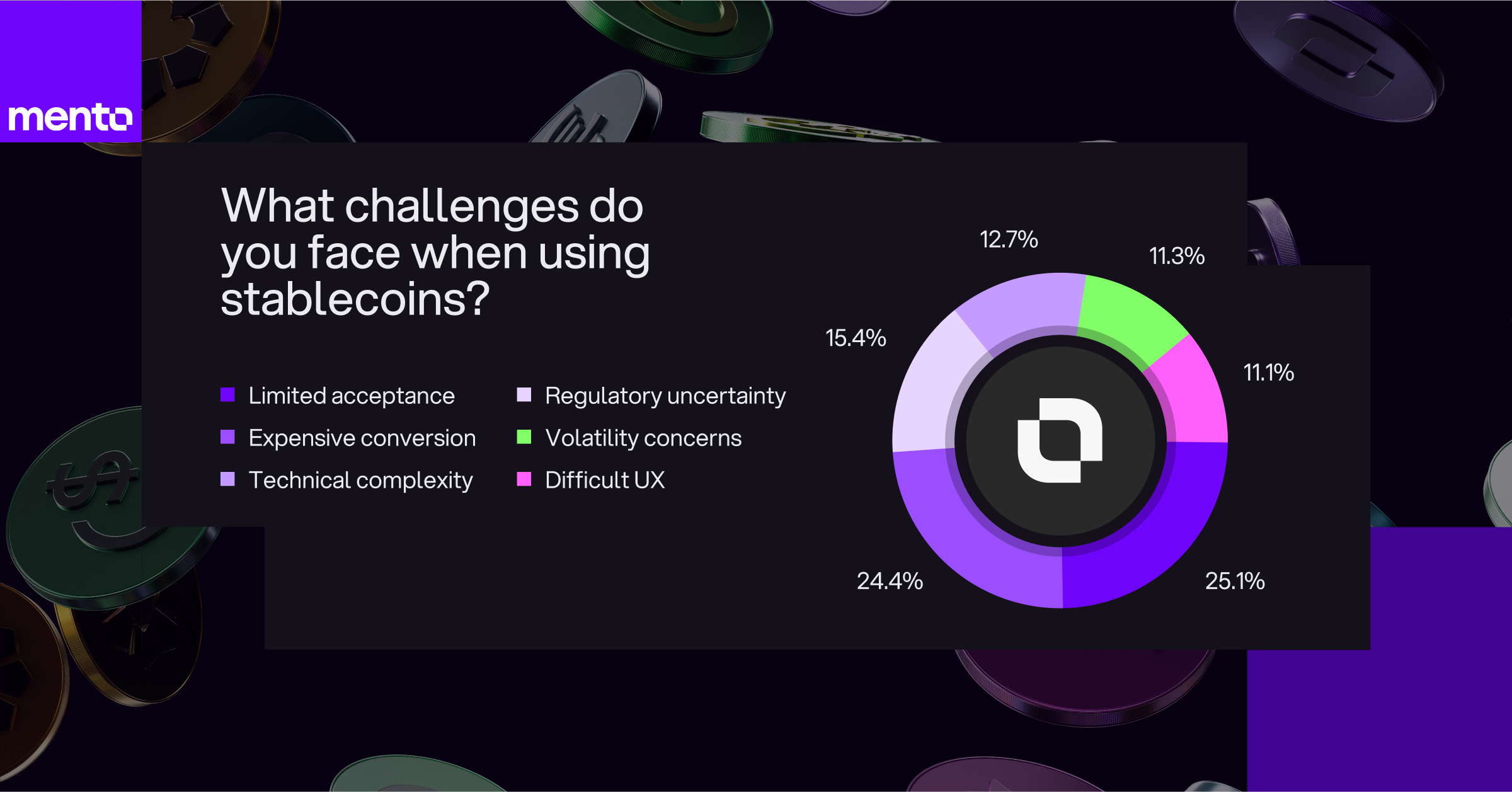

Common Challenges

Users surveyed in Africa identified three main areas for improvement: Limited acceptance of stablecoins, expensive conversion fees and technical complexity. These were followed by other challenges like stability concerns and regulatory uncertainty.

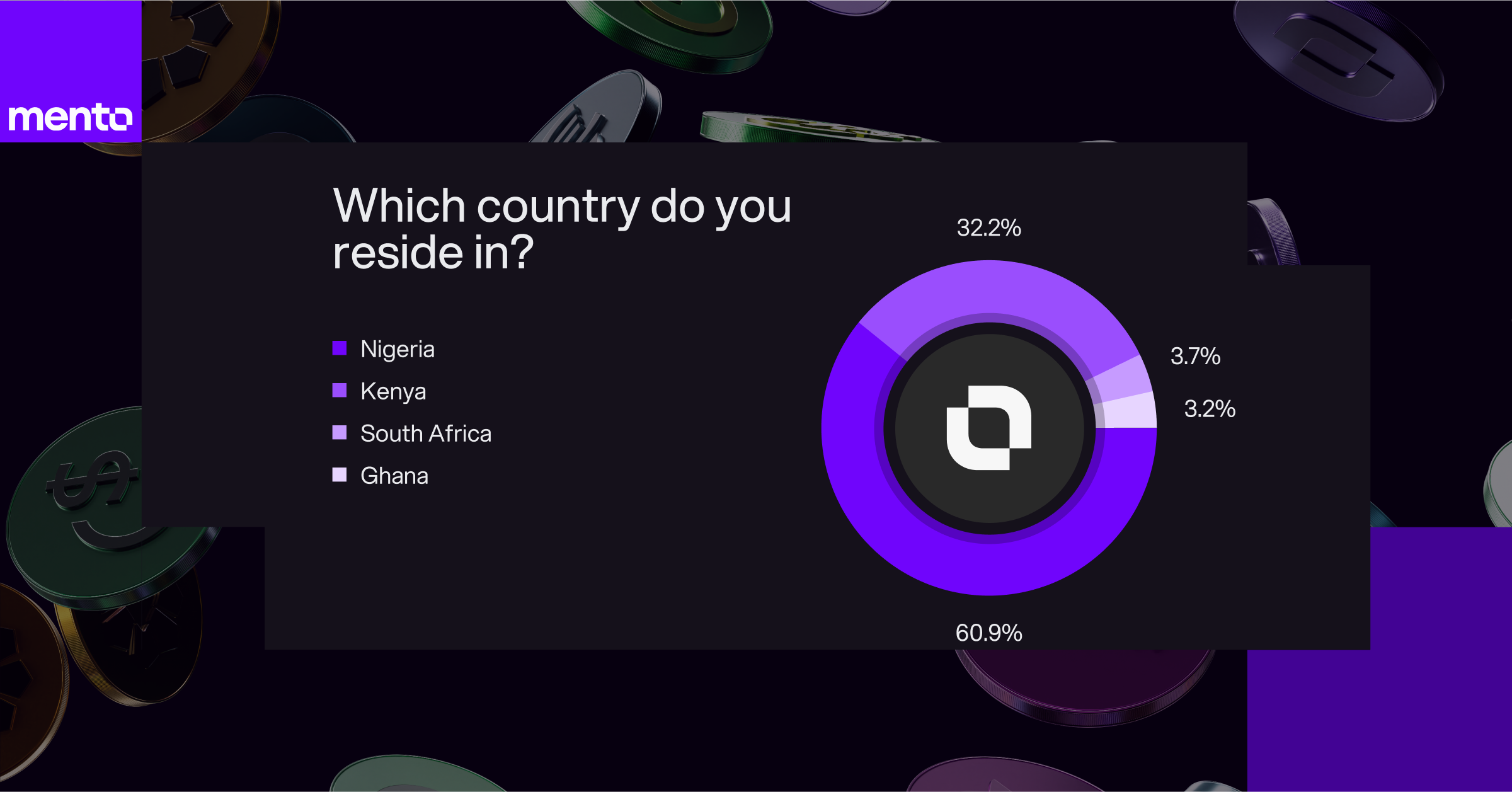

Where Are Stablecoin Users Located in Africa?

The survey gathered responses from users across several African countries. Nigerian participants made up 60.9% of survey responses, followed by Kenyan participants at 32.2%. South African and Ghanaian respondents represented 3.7% and 3.2% of responses respectively.

Impact on Financial Access

Stablecoins have made a positive difference for most of the survey respondents - 64.7% of users report major improvements in their ability to participate in digital commerce. Another 24.3% note some improvement, while 9.5% see no change. Only 1.1% report a negative impact.

Staying Informed

Social media serves as the main information source for 69.6% of users surveyed in Africa. Crypto communities inform 24.8% of users, while traditional news outlets reach 2.7%. Word of mouth and government announcements each inform 1.4% of users.

What Do Users Want?

Based on the survey data, we observed three main challenges in using and accessing stablecoins. A small group of users reported a smooth experience with no issues, while others highlighted challenges with cash conversion and limited access to services. The majority of respondents, however, raised concerns about security, price stability, and unclear regulatory environments.

Users also provided clear feedback on desired improvements. Many want stablecoins accepted in more locations and to be easier to use. A significant number emphasized the need for keeping their money safe and stable. Additionally, several users requested lower fees and more opportunities to earn returns on their stablecoin holdings.

Interest-earning accounts and saving programs are some of the suggested features users would like to see. Many also seek more seamless ways to convert local money into stablecoins. There is also a clear demand for easy-to-use apps and improved integration with other financial services to make stablecoins more accessible and easier to use.

Join Us in Building an Inclusive Future with Stablecoins

These insights are aimed to guide our development at Mento Labs. We are working with our partners in the Mento Ecosystem on building solutions to address users’ challenges and create solutions tailored to the Mento Community needs. To connect with us:

Join the Mento Discord

Follow us on X/Twitter

Thank you to everyone who participated in this survey. Your input shapes the future of accessible finance with stablecoins

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)